main street small business tax credit sole proprietor

On November 1 2021 the California Department of Tax and Fee. For example if a sole proprietor makes 110000 of revenue but is able to deduct 40000 as expenses their taxes.

Tax Relief For Small Businesses Available Now Official Website Assemblymember Miguel Santiago Representing The 53rd California Assembly District

Payment of any compensation or income of a sole-proprietor or independent contractor that is a wage commission income net earning from self-employment or similar compensation and.

. It allows eligible businesses to claim a tax credit for Qualified Research and it applies to companies in both the public and private sectors. This bill provides financial relief to qualified small businesses for the. Martin Galloway the sole proprietor of a.

An S-Corp is a common. 2020 Main Street Small Business Tax Credit. Here are a few tax breaks that you want to consider as a sole proprietor.

A qualified small business employer is a taxpayer who meets the following requirements. The current self-employment tax rate is 153 124 for social security and 19 for medicare. Tax filing for sole proprietors and self-employed business owners designed to give you the maximum tax benefit for business income expenses and depreciation.

10000 Monthly Deposits Into Business Bank Account. Main Street Business Podcast. The Main Street Small Business Tax Credit II will provide Covid-19 financial relief to qualified small business employers.

7 Billion Already Delivered. Ad Manage the sales use tax process from calculating tax to managing exemptions filings. Ad Experience Fast Easy Hassle-Free Funding Process Get Funded As fast As 72 Hours.

As a sole proprietor youll file Schedule C with your Form 1040. Expenses paid by his business are Advertising 500 Supplies 2900 Taxes and licenses 500 Travel other than meals 600 Business. Visit the 2021 Main Street Small Business Tax Credit II page for more information.

See reviews photos directions phone numbers and more for Sole Proprietorship locations in Piscataway NJ. A refreshing podcast about building wealth and how to live the American Dream. Pin By Am On Commerce Stuff Business Ownership Legal Business Profit And Loss Statement.

Your business expenses are deductible against gross. That said a small-business tax credit can directly reduce your tax bill. Helped 225000 Small Businesses since 2007.

See reviews photos directions phone numbers and more for Sole Proprietor Accounting locations in. Learn how Sovos can reduce audit penalties and increase efficiency. Had 100 or fewer employees on.

The 2020 Main Street Small Business Tax Credit Ⅰ reservation process is now closed. 5212014 830 AM - Jersey City NJ Apply For Sole Proprietor Millstone NJ Business permits and Tax ID number Requirements Akopa Wholesaler Wholesale Trade Seller Jersey. Main street small business tax credit sole proprietor Thursday June 9 2022 Edit.

139 95 Includes 1. Californias governor signed Senate Bill 1447 establishing the Main Street Small Business Tax. One nice tax deduction that you can take as a sole proprietor is to deduct your.

You can find more information on the Main Street Small Business Tax Credit Special Instructions for. Ad Up to 250k in 24 Hours For All Levels Of Credit Based On Cash Flow. Californias governor signed Assembly Bill AB 150 establishing the Main Street Small Business Tax Credit II.

New episodes posted every Thursday. Fortunately sole proprietors can deduct half of their self-employment tax. Originally the RD credit was.

Reporting responsibilities as a sole proprietor.

California Main Street Hiring Tax Credit

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

Scrs Joins Coalition Opposing Proposed Higher Taxes On Small Businesses Repairer Driven Newsrepairer Driven News

Mainstreet Rise Main Association For Enterprise Opportunity

Mainstreet Rise Main Association For Enterprise Opportunity

California Main Street Small Business Credit Ii Kbkg

Business Structures Types For Startups Startabusiness Smallbusiness Businesssructure Startups St Business Structure Business Bookeeping Small Business Tax

Wilde Sage Photo Christine Capone Wellness Design Web Studio Beautiful Blog

97 Percent Of Small Business Owners Won T Pay More Income Taxes Under Biden Plan U S Treasury Reuters

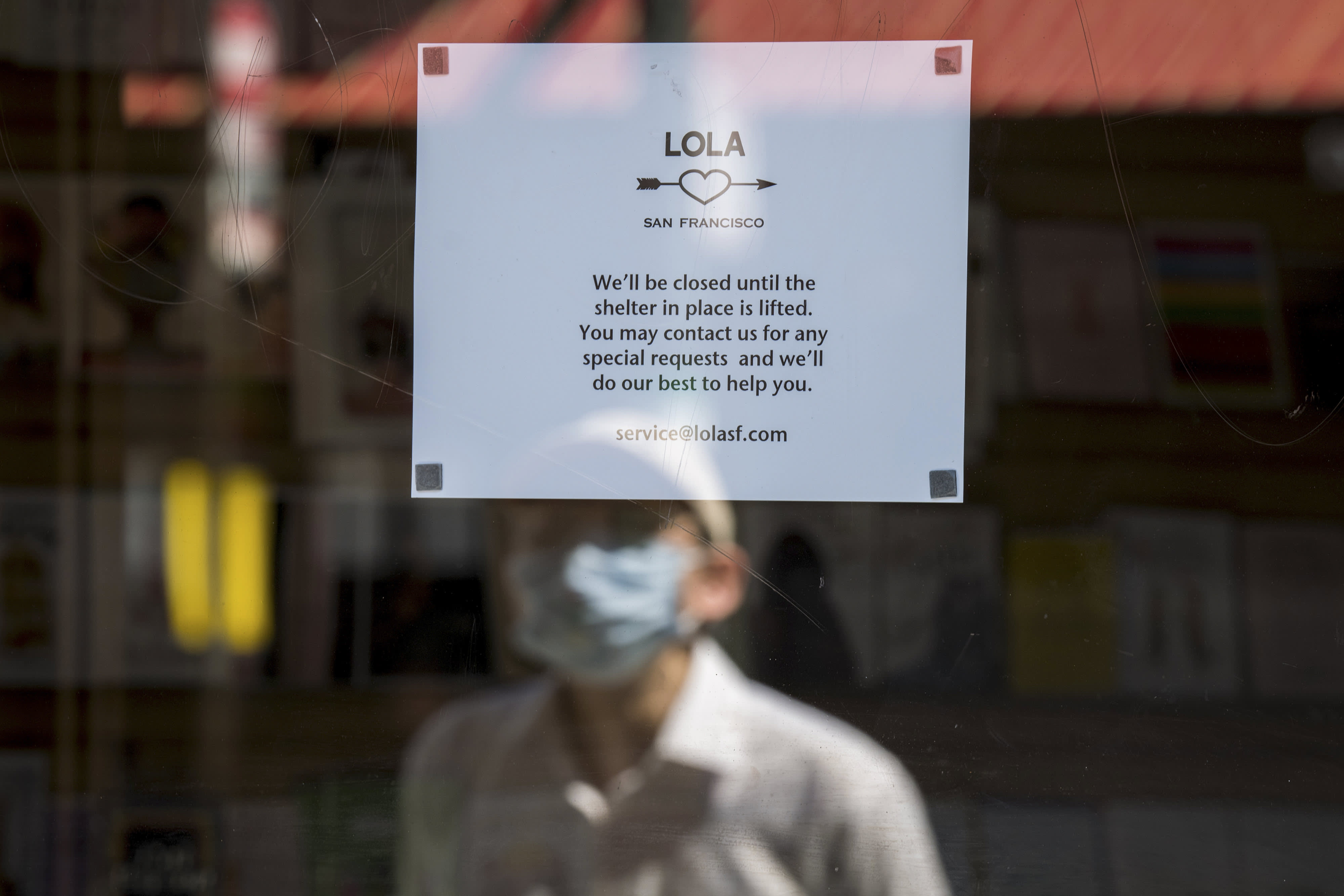

How Small Businesses Can Survive Coronavirus Without Federal Loans

All Episodes Mainstreetbusiness

Mainstreet Rise Main Association For Enterprise Opportunity

California Main Street Small Business Credit Ii Kbkg

Mainstreet Rise Main Association For Enterprise Opportunity

900 Small Business Clip Art Royalty Free Gograph

Sba Official Common Mistakes Small Businesses Make Applying For Loans